Eb5 Investment Immigration - The Facts

Eb5 Investment Immigration - The Facts

Blog Article

The Buzz on Eb5 Investment Immigration

Table of ContentsThe Basic Principles Of Eb5 Investment Immigration The Main Principles Of Eb5 Investment Immigration Unknown Facts About Eb5 Investment ImmigrationThe 45-Second Trick For Eb5 Investment ImmigrationThe Ultimate Guide To Eb5 Investment Immigration

Based upon our latest clarification from USCIS in October 2023, this two-year sustainment duration begins at the factor when the capital is spent. The period can be longer than two years for a couple of factors. Initially, one of the most recent upgrade from USCIS does not clear up the moment frame in which the funding is taken into consideration "invested." On the whole, the beginning of the duration has actually been taken into consideration the factor when the money is deployed to the entity in charge of job creation.Find out more: Comprehending the Return of Capital in the EB-5 Refine Understanding the "at threat" need is crucial for EB-5 capitalists. This concept emphasizes the program's intent to foster genuine financial task and work production in the USA. The investment comes with inherent risks, cautious job option and conformity with USCIS standards can help capitalists achieve their objective: permanent residency for the financier and their family members and the eventual return of their resources.

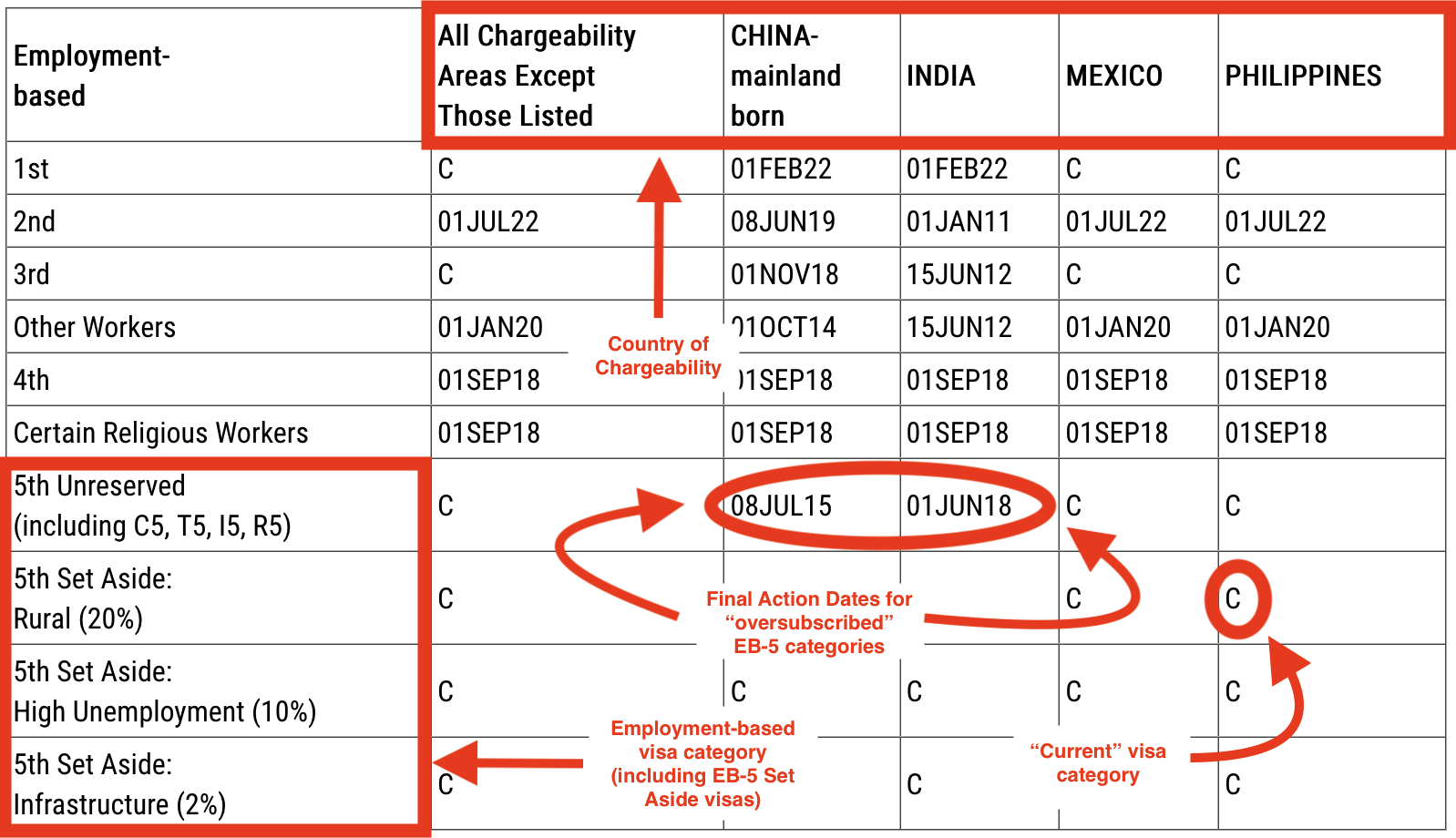

To come to be qualified for the visa, you are needed to make a minimal investment depending upon your picked financial investment option. EB5 Investment Immigration. 2 financial investment choices are available: A minimal direct financial investment of $1.05 million in an U.S. business beyond the TEA. A minimum financial investment of a minimum of $800,000 in a Targeted Employment Area (TEA), which is a rural or high-unemployment area

The Single Strategy To Use For Eb5 Investment Immigration

For consular handling, which is done with the National Visa Facility, the immigrant visa handling fees payable each is $345. If the capitalist is in the United States in an authorized condition, such as an H-1B or F-1, he or she can file the I-485 type with the USCIS- for adjusting condition from a non-immigrant to that of permanent local.

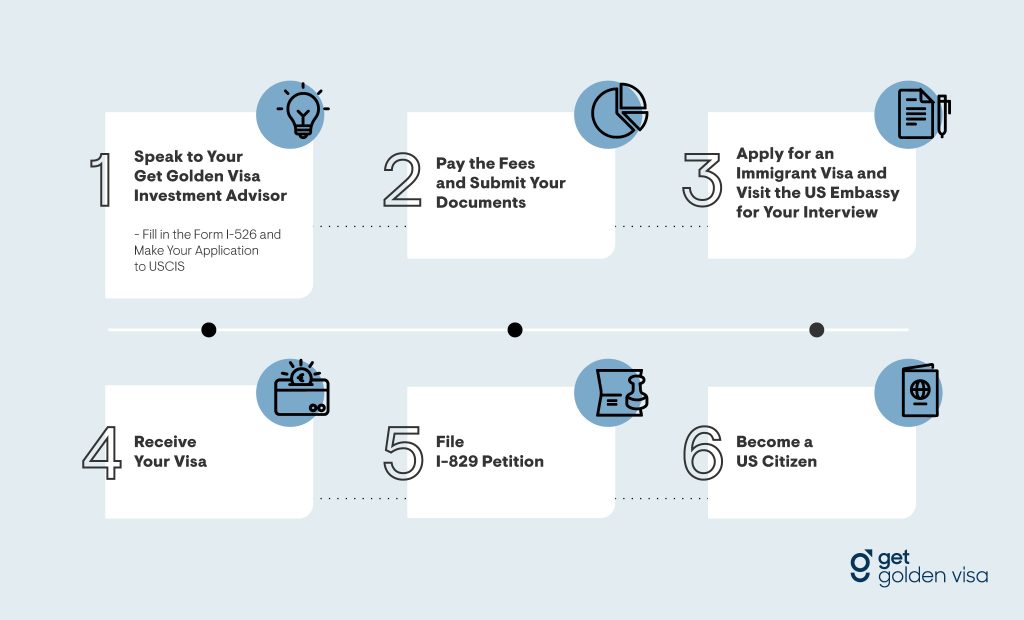

Upon approval of your EB5 Visa, you get a conditional irreversible residency for 2 years. You would certainly require to submit a Type I-829 (Petition by Capitalist to Eliminate Conditions on Permanent Citizen Standing) within the last 3 months of the 2-year credibility to eliminate the conditions to come to be an irreversible local.

Nonetheless, as per the EB-5 Reform and Stability Act of 2022, regional facility investors have to also send an additional $1, 000 USD as part of submitting their application. This added expense doesn't apply to a modified demand. If you selected the alternative to make a straight investment, after that you 'd need to connect an organization strategy in addition to your I-526.

A Biased View of Eb5 Investment Immigration

In a straight investment, the financiers structure the financial investment themselves so there's no additional administrative cost to be paid. There can be expert fees borne by the investor to make sure conformity with the EB-5 program, such as legal fees, company plan writing charges, economist fees, and third-party reporting charges among others.

In addition, the capitalist is likewise accountable for acquiring a company strategy that complies with the EB-5 Visa needs. This additional expense might range from $2,500 to $10,000 USD, relying on the nature and framework of business. EB5 Investment Immigration. There can be more costs, if it would be sustained, as an example, by market research

An EB5 capitalist must also think about tax obligation factors to consider for the duration of the EB-5 program: Since you'll become a long-term local, you will certainly undergo income tax obligations on your worldwide earnings. You have to report and pay taxes on any income gotten from your financial investment. If you offer your financial investment, you may go through a funding gains tax obligation.

Some Ideas on Eb5 Investment Immigration You Should Know

If you're preparing to spend in a local facility, you can look for ones that have low costs yet still a high success rate. This makes certain that you shell out much less money while still having a high opportunity of success. While working with a legal representative can include in the costs, they can help in reducing the total prices you have to pay over time as attorneys can ensure that your application is full and accurate, which lessens the chances ofcostly mistakes or hold-ups.

What Does Eb5 Investment Immigration Mean?

The locations beyond metropolitan statistical locations that certify as TEAs in Maryland are: Caroline Area, Dorchester Region, Garrett Area, Kent Region and Talbot Area. The visit homepage Maryland Division of Business is the designated authority to certify areas that certify as high unemployment locations in Maryland based on 204.6(i). Commerce licenses geographic locations such as counties, Census marked places or census systems in non-rural counties as areas of high joblessness if they have unemployment prices of at least 150 percent of the nationwide unemployment rate.

We evaluate application demands to accredit TEAs under the EB-5 Immigrant Investor Visa program. EB5 Investment Immigration. Demands will certainly be evaluated on a case-by-case basis and letters will be issued for locations that satisfy the TEA requirements. Please assess the actions listed below to identify if your proposed job remains in a TEA and adhere to the guidelines for requesting an accreditation more tips here letter

Report this page